Containers

First-class analysis of a constantly changing market

The twists and turns of the global container shipping industry require constant attention. An enthusiastic and experienced team of professional maritime economists and data analysts between them maintain global trade and container shipping databases which enables the up-to-date data and expert analysis that clients demand.

Internationally recognised source of independent data, forecasts and market analysis

Data and analysis is supplied on a regular basis:

HOW CAN WE HELP YOU?

SUBSCRIBE TO OUR LATEST THINKING

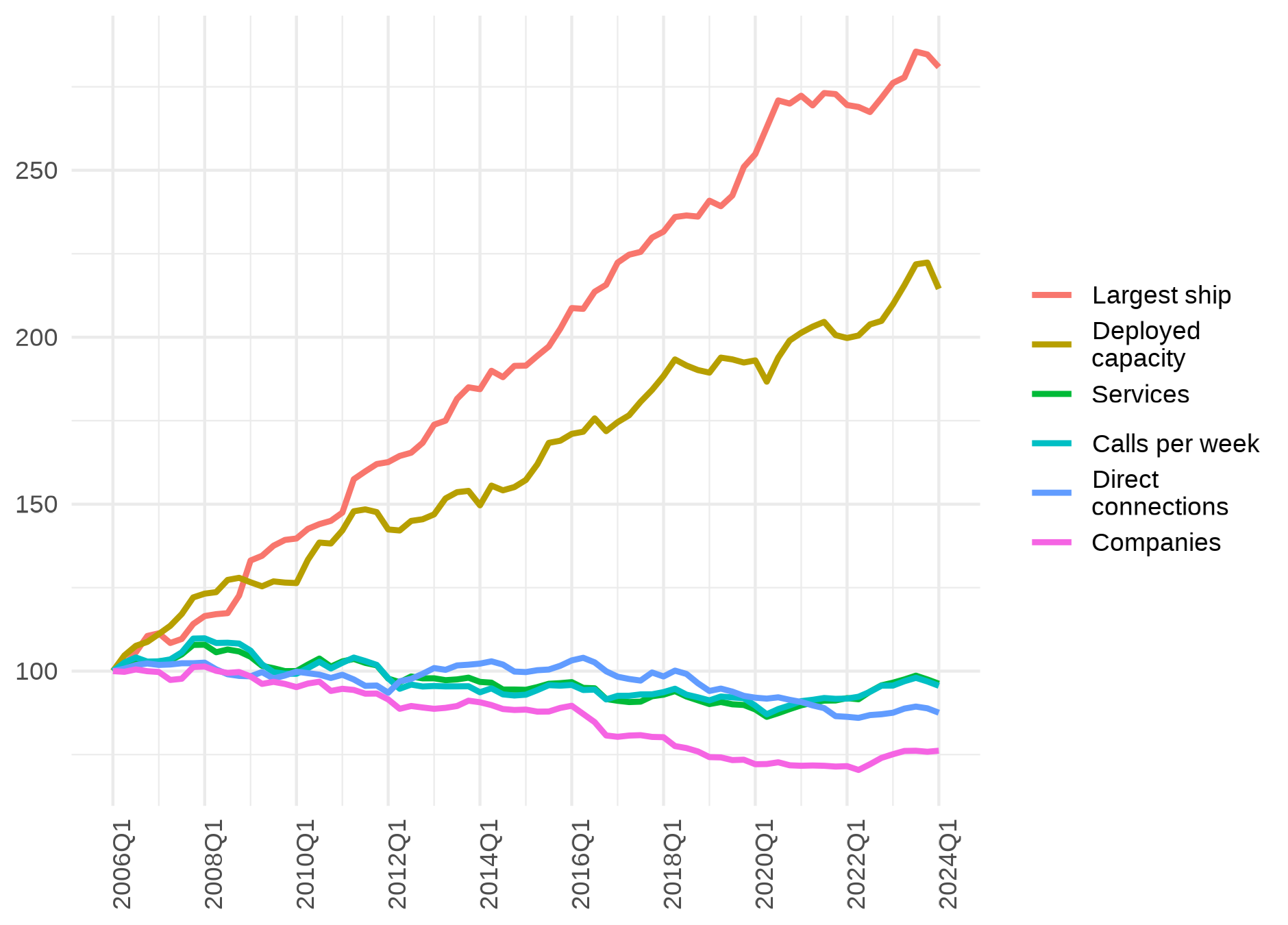

United Nations Conference on Trade and Development (UNCTAD) has published its latest Liner Shipping Connectivity Index (LSCI) which now uses data supplied by MDS Transmodal from its Containership Databank. UNCTAD’s key role is in supporting developing countries to access the benefits of a globalized economy more fairly and effectively.

High level analysis of global containerised trade, global container shipping supply and the supply-demand balance is published each month in the Containers section of Lloyds information portal. Our forecasts are regularly covered in Lloyds List.

To see our latest insights on latest events in the container shipping market, click here

Why MDST?

MDS Transmodal is a recognised authority for data and trade analysis of the global container fleet and global container market. Our data analysis is sought by a variety of companies and clients around the world. Outputs are used by UNCTAD and published in specialized trade magazines.

We supply data, analysis and comment to container shipping lines, global port and terminal operators, shippers, trade associations and financial institutions.