Pricing in road pricing

- By Chris Rowland

- •

- 29 Apr, 2024

Is road pricing back on the agenda?

2024 will be an election year in the UK and trade associations are seeking to influence the content of the political parties’ manifestoes. Logistics UK, the trade body that represents the third party logistics providers and large-scale shippers and receivers of goods, published its own pitch called Unleashing the power of logistics to drive growth across the whole economy in January. At the end of the chapter on the theme of a Fair transition to a green economy, in which it argued for a “co-created logistics roadmap to net zero and the phase-out of fossil fuels”, it slipped in a request for, “The government to work with our sector on plans for road pricing”.

At one level it seems rather odd for a trade association to be so open to the introduction of a new form of taxation on its members’ activities, but the logistics industry in the UK seems to have realised that being taxed for use of the highways network is unavoidable and it’s best to engage with the process. When asked whether his members regarded road pricing as inevitable by the Chair of the House of Commons Transport Committee in October 2021, a representative of the Road Haulage Association (RHA) - which represents the small and medium-sized road hauliers – replied, “Yes, I think so”.

The need for road pricing

The Transport Committee thinks the introduction of road pricing is inevitable as well. In its report on the subject in February 2022, the committee of MPs pointed out that if the existing taxes on motoring - Fuel Duty (a tax per litre of fuel purchased) and Vehicle Excise Duty (VED, an annual tax on each vehicle on the road) were abolished, the government would need to increase income tax by the equivalent of 5p in the pound to recoup the lost tax revenue. And yet, without a change in approach, policies to deliver net zero emissions by 2050 will inevitably result in a calamitous reduction in tax revenue for the Government from motoring taxation by 2040, given that the Fuel Duty provided 77% of tax revenue in 2022-23 and, on its own, is the equivalent of 1% of the UK’s Gross Domestic Product. That pays for a lot of new hospitals.

The politics of road pricing

The Committee recommended that the Treasury and the Department for Transport jointly set up an arm’s length body by the end of 2022 to recommend a new road charging mechanism and argued that this work was urgent. The Chancellor of the Exchequer then took ten months to respond to the Committee’s report and wrote, “The Government is focused on delivering its core priorities, as set out in the 2019 manifesto. As such, the government does not currently have plans to consider road pricing.”

The Government, which in an election year is keen to support people to "use their cars to do all the things that matter to them", is not therefore prepared to even think about future options for road pricing that would then be implemented by a new administration of whatever colour. Road pricing has historically been unpopular; in early 2007, during the second Blair administration, an online petition against the concept of road pricing appeared on the 10 Downing Street website after the Department for Transport (DfT) dared to suggest some pilots should be carried out on the idea. It rapidly attracted 1.8 million digital signatures and Number 10 told the DfT to drop the pilots.

As Professor Stephen Glaister pointed out in 2014, “It has become a standing joke that even if any UK politician is unable to deny the logic of the case for some form of road pricing, they are never willing to implement it within the next ten years—by which time they will be long gone.”

Picking on freight

Despite politicians’ understandable lack of courage on the subject after the debacle of early 2007, the option remains to implement road pricing only for road freight movements. The road haulage industry would appear to regard road pricing as inevitable and would engage in the process. And, in an election year, we should remember that freight doesn’t vote.

Picking on freight for the roll-out of road pricing as a policy has been implemented successfully elsewhere. In 2005 the Maut distance-based toll system was introduced for HGVs in Germany and the scope of the Maut has gradually been increased in terms of the size of the vehicle from only HGVs over 12 tonnes to all HGVs and by varying charges according to the emissions of the HGV. The German government originally intended to extend the system to include vehicles driven by the voting public, but finally abandoned the idea in 2019.

Modelling road pricing in Great Britain: the scenario

This renewed attention on HGV taxation, reminded us that back in 2007 (appropriately enough) MDS Transmodal completed a study for Transport 2000 (now the Campaign for Integrated Transport) on the impact of a system of road pricing using its multimodal freight transport demand model, the Great Britain Freight Model (GBFM).

It remains to be seen exactly how a future road pricing scheme might be introduced in the future, but for the purposes of the study MDST developed a “Road Pricing Scenario” based on internalising all the theoretical net external costs (such as the cost of emissions, congestion imposed on other road users and the cost of accidents) as encapsulated monetarily in what were called at the time Sensitive Lorry Mile (SLM) values. These are similar to the Modal Shift Benefits (MSBs) values per mile that are still used by the DfT to justify subsidies to the rail freight industry when rail removes HGVs from the highways network.

Such a system of road pricing would essentially be distance-based, but would also vary very significantly according to the type of road as the values are heavily weighted towards the costs of congestion imposed on other road users by the presence of an HGV on the network. The SLM values back in 2007 were £0.69 per HGV mile on a highly congested motorway and £1.74 per mile on a minor road in an urban area, but only £0.04 per mile on a low congestion motorway. This meant that the SLM value per mile for an HGV on the M6 through the centre of Birmingham was over 43 times the charge on the same motorway in Cumbria!

This “Road Pricing Scenario” was then compared with a counterfactual called the “Policy Neutral Scenario” where the same amount of aggregate demand for freight was moving between the same origins and destinations within the model, but with the taxation of HGVs remaining as VED being an element of the fixed cost per hour and Fuel Duty being a significant proportion of the variable cost per mile.

Modelling road pricing in Great Britain: the results

The results of the modelling suggested that such a system of road pricing would secure some environmental benefits, but there would also be some unintended consequences.

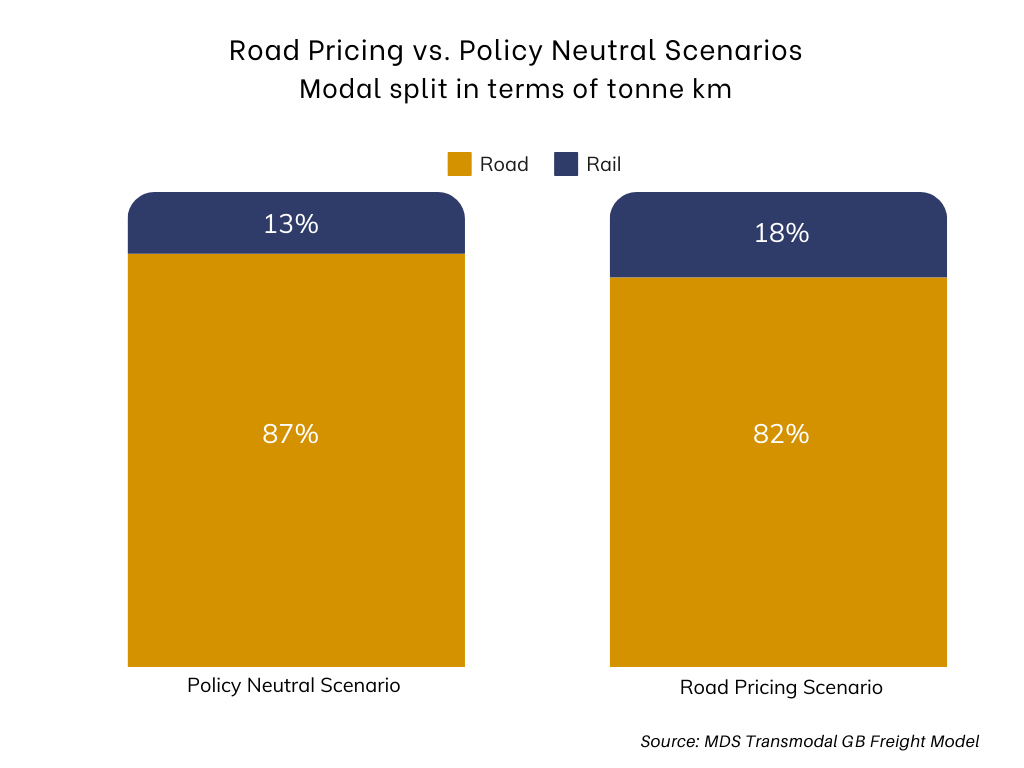

On the positive side, there was a significant shift away from road to rail freight, with an 80% increase in tonne kilometres transported by rail freight. This was partly due to some of the assumptions which favoured rail in any case, such as the availability of additional capacity at rail-connected distribution parks, but was mainly due to road freight being required to pay for its full net external costs. This extent of modal switch is, as it happens, very similar to the Government’s relatively new rail freight target of 75% growth by 2050.

There was also a switch of international freight traffic through ports away from the shorter ferry routes - principally across the Short Straits - to longer distance RORO routes via the major east coast estuaries, due to a proportion of the market choosing to take a longer crossing of the North Sea to avoid congested (and therefore relatively costly) sections of the motorway network in the south of England. To illustrate these elasticities, such a switch has already occurred gradually since 2016, as additional costs have been incurred by trucks using the Short Straits as a result of Brexit.

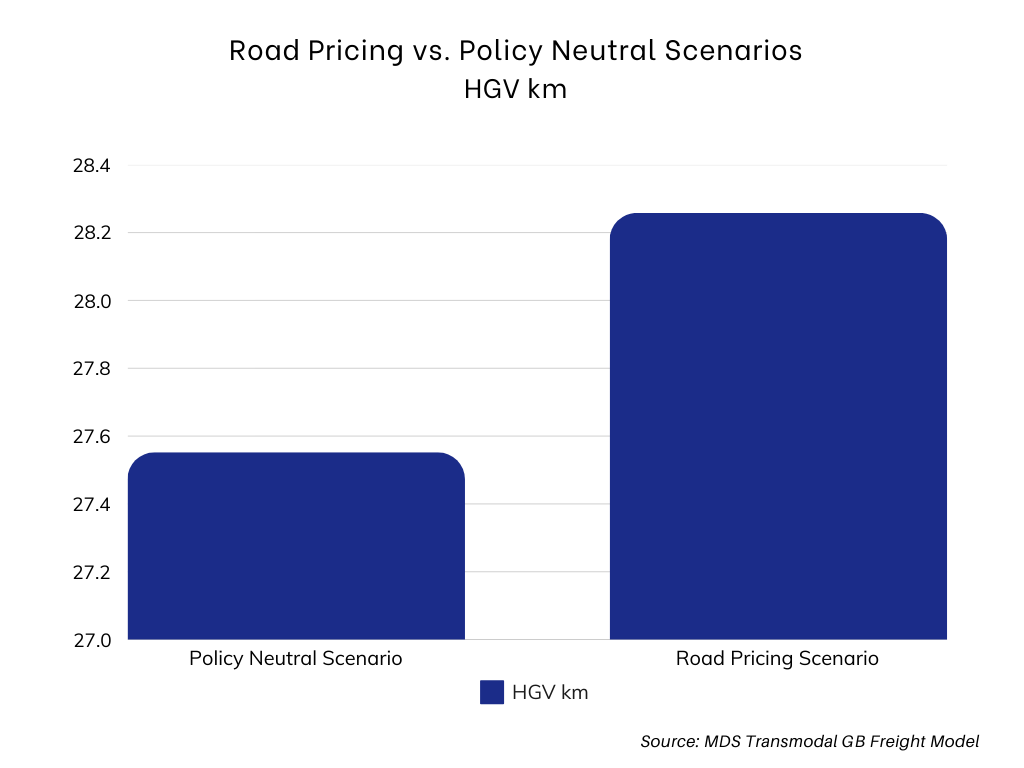

However, there was also the unintended consequence of a significant diversion of road freight flows away from what were regarded at the time as congested roads to less congested sections of the highways network. This completely rational approach on the part of road hauliers to minimise door-to-door costs and avoid the very high distance-based additional charges on certain sections of the motorway network was so great that there was an increase in the HGV kilometres required in the Road Pricing Scenario compared to the Policy Neutral Scenario. While some 27.6 billion HGV kilometres of road freight were required under the Policy Neutral Scenario, this increased to 28.3 billion HGV kilometres under the Road Pricing Scenario.

This rather perverse result is due to HGV traffic choosing to divert to take longer but - according to the SLM valuations – more “environmentally sustainable” routes to minimise door-to-door costs as a direct consequence of the introduction of a system of road pricing. Policy priorities have changed and an approach to road pricing which focuses to such a great extent on congestion, rather than the cost of carbon, would not be appropriate.

The way forward

The results of the modelling and lessons from the Maut in Germany suggest that a system of road pricing for HGVs in Great Britain with the urgent objective of reducing CO2 emissions from road freight should be:

- Comprehensive, including the entire GB road network to avoid diversion of traffic onto secondary roads;

- Distance-based, to reflect use of the network;

- Transparent, with clear charges for the use of different roads by network link;

- Fair, including all HGVs operating on the British road network wherever the HGVs are registered and replacing Fuel Duty and VED with charges per kilometre that vary according to the net externalities (including emissions and congestion);

- Differentiated, to charge only diesel HGVs for the cost of carbon emissions at the tailpipe, as well as other emissions;

- Signalled well in advance, so that hauliers can plan their investments to minimise their costs in a way which also addresses the need to minimise the impact of climate change.

While road pricing is unlikely to appear in the manifesto of any of the political parties later this year, the logistics industry regards it as inevitable and is likely to accept its introduction if a scheme was designed to incentivise the switch to zero emission vehicles up to 2040 and then charged for use of the network on a comprehensive, consistent and transparent basis over the longer term.

Will any of the political partes find the political courage to take up the challenge?